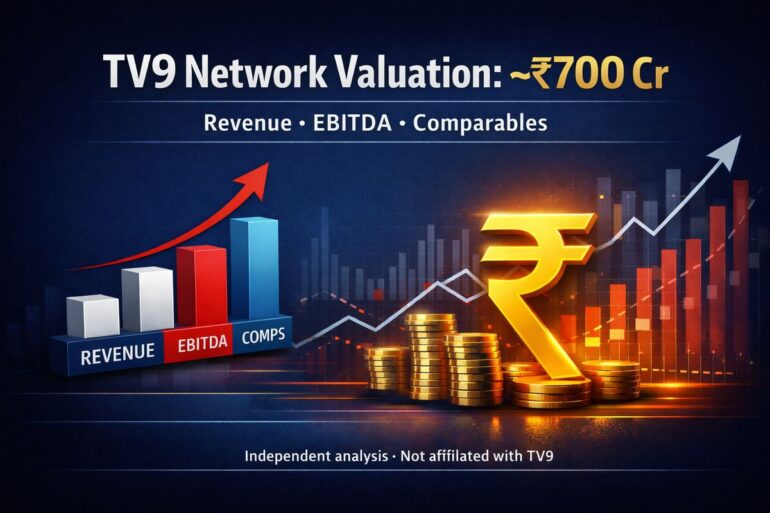

– Surendranadh | Media & Telecom Valuation Analyst

A controlling stake(~ 60%) in TV9 Network is reportedly up for sale. Whenever a large controlling stake is up for sale, valuation expectations tend to vary widely – especially in private deals. This article explains a realistic valuation in a simple way, using three reliable reference points:

(1) TV9’s operating income and profitability as reported by ICRA,

(2) the last major price-discovery transaction in 2018, and

(3) the listed-market benchmark TV Today Network (India Today Group’s listed company).

1) What does TV9 earn in a year?

ICRA’s consolidated financial indicators for Associated Broadcasting Company Pvt Ltd (ABCPL) ,the TV9 Network parent, show the following:

• Operating Income: FY23 ₹630.8 cr | FY24 ₹707.0 cr | FY25 ₹749.0 cr

• OPBDIT Margin: FY23 14.2% | FY24 11.5% | FY25 15.7%

In plain terms: TV9 is a ₹700–₹750 crore annual-revenue news network, with FY25 showing a stronger profit profile.

2) A real historical benchmark: what was TV9 valued at in the last big deal?

In August 2018, when a major stake changed hands, Times of India and many other media reported the TV9 network company was valued at around ₹456 crore for that transaction.

3) The listed benchmark: TV Today Network (India Today Group’s listed entity)

TV Today Network’s current market cap is about ₹802 crore. On a full-year basis, FY25 (FY 2024–25) revenue from operations is ~₹993 crore, while the trailing 12-months revenue is ~₹867 crore. Market data sources show TV Today’s enterprise value (EV) around ~₹596 crore, which is lower than market cap because the company appears to carry net cash/low debt.

This matters because a listed company’s EV-to-revenue multiple offers a reality check for what public markets pay for an Indian news/media business.

4) A simple valuation of TV9 network

Using ICRA FY25 numbers:

• Operating Income = ₹749 crore

• OPBDIT margin = 15.7% → OPBDIT ≈ ₹118 crore

Now, here are two clean valuation lenses commonly used in media deals:

A) EV based on revenue multiples (FY25 revenue = ₹749 cr)

EV/Revenue 0.9x → ₹674 cr

EV/Revenue 1.0x → ₹749 cr

EV/Revenue 1.1x → ₹824 cr

B) EV based on operating profit multiples (FY25 OPBDIT ≈ ₹118 cr)

EV/OPBDIT 6x → ₹706 cr

EV/OPBDIT 7x → ₹823 cr

These two methods broadly converge around the same zone.

5) Conclusion: a realistic, conservative estimate

Based on TV9’s FY25 operating scale and profitability, the 2018 deal benchmark, and the listed benchmark TV Today Network, a conservative and realistic enterprise value estimate for TV9 is around ₹700 crore

For a near 60% control stake, the starting point should remain grounded in revenue and operating profitability. It will fetch around ₹400 crores for the ~ 60% stakeholder.

(Disclosure: This is an analytical estimate based on publicly available information; private-company valuations are indicative ranges and can vary with deal terms.)